Donald Trump’s political statements often shake the stock market. For long-term investors, this volatility can create real opportunities when approached with discipline and strategy.

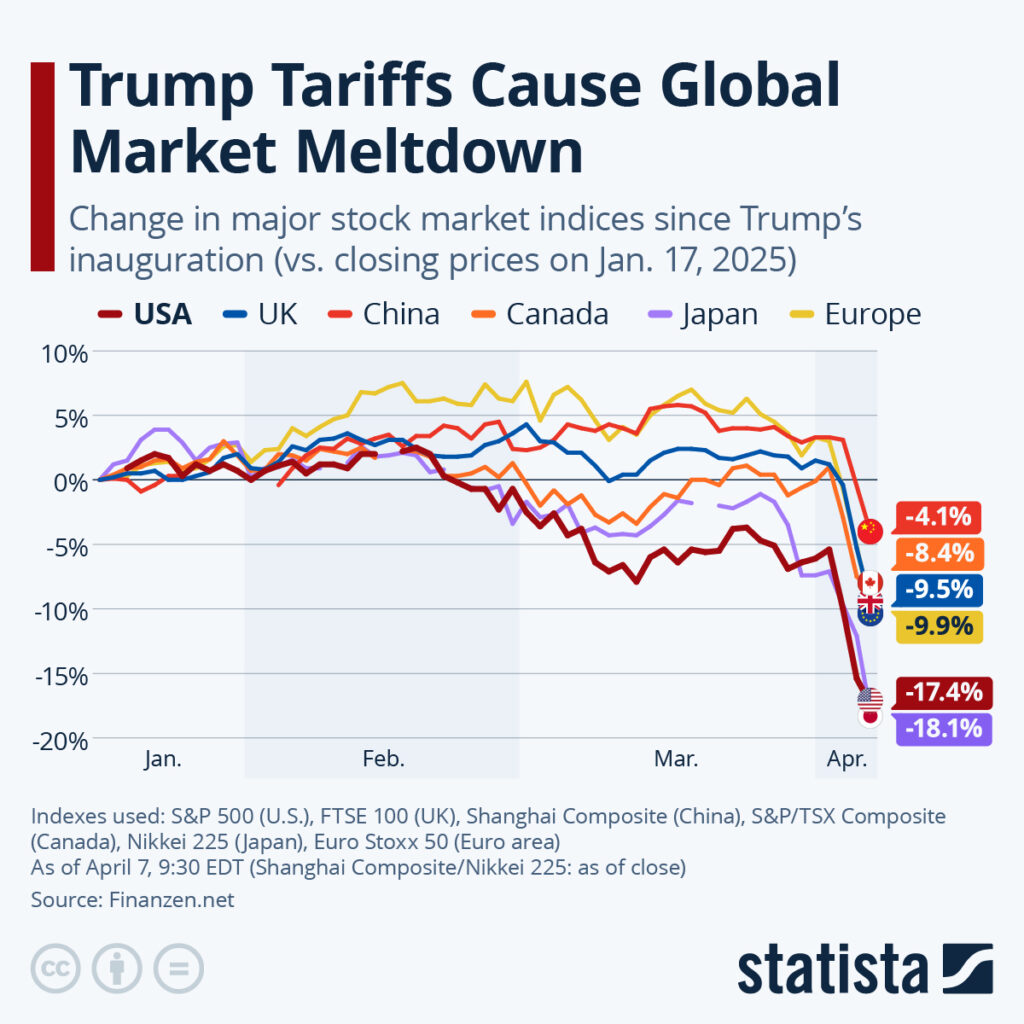

Over the past several years, nearly every major public statement by Donald Trump has seemed capable of triggering an immediate reaction in financial markets. Tariff threats, trade disputes, aggressive rhetoric, or attacks on monetary institutions have repeatedly led to sharp spikes in volatility.

The influence of Donald Trump on the stock market has therefore become a central concern for many investors. Yet beneath these sometimes spectacular movements lies a more nuanced reality. Politics affects prices in the short term, but it rarely determines long-term value creation. For disciplined investors, this distinction is critical, as it transforms what appears to be risk into a strategic opportunity.

Why Donald Trump Creates So Much Stock Market Volatility ?

Financial markets operate on expectations. Donald Trump’s political style is built on unpredictability and direct communication, a combination that naturally fuels uncertainty — a factor markets immediately price in.

When a new announcement emerges, markets do not attempt to measure its long-term economic impact right away. Instead, valuations are rapidly adjusted based on worst-case scenarios. Algorithmic trading, passive investment flows, and intense media coverage amplify these reactions, often far beyond what underlying fundamentals would justify.

The result is a series of fast, sometimes chaotic corrections that temporarily disconnect stock prices from the intrinsic value of the businesses themselves.

The Classic Trap: Confusing Volatility With Risk

For many investors, a sharp decline triggered by political news is perceived as an immediate threat. This perception frequently leads to rushed selling decisions driven by fear rather than analysis.

Yet volatility is not the same as permanent risk. True risk emerges when a company’s fundamentals deteriorate in a lasting way. In most cases, a political statement does not alter a company’s long-term profitability, competitive advantage, or ability to generate cash flows.

Selling during moments of panic often turns temporary discomfort into permanent capital loss.

High-Quality Companies Outlast Political Cycles

One of the most consistent lessons in market history is the resilience of exceptional businesses. A strong business model, a dominant market position, disciplined capital allocation, and recurring cash flows do not disappear because of political noise.

These companies adapt. They adjust supply chains, revise investment priorities, and absorb regulatory changes. Political cycles are short. High-quality companies, by contrast, operate over decades.

For long-term investors, confidence in the businesses they own becomes a genuine competitive advantage. It allows rational decision-making when markets turn emotional.

How Investors Can Truly Benefit From Trump-Driven Volatility ?

Periods of volatility linked to Donald Trump and the stock market are not merely episodes to endure. They can become strategic entry points.

When markets sell off indiscriminately, they often punish strong companies for reasons unrelated to their intrinsic value. These moments create rare opportunities: acquiring quality businesses at temporarily depressed prices.

To benefit from such situations, investors must have a clear investment thesis. Understanding why a company is owned, how it grows, how it generates cash, and over what time horizon it creates value is essential. Preparation allows calm, rational action when markets become unstable.

Used correctly, volatility becomes a tool — one that can improve long-term returns while reducing real risk, provided discipline is maintained.

Patience as an Investment Strategy

Long-term investing does not mean ignoring political developments. It means refusing to give them excessive weight in decision-making.

History shows that markets eventually refocus on fundamentals. Periods of political stress are often followed by normalization phases, sometimes rapidly, as emotion fades and economic results regain center stage.

The investors who succeed are not those who avoid every downturn, but those who remain invested in businesses they understand and trust, despite the surrounding noise.

Politics and Markets: A Structural Disconnect

No president controls the deep drivers of stock market performance. Innovation, productivity, return on capital, and financial discipline remain the true engines of long-term wealth creation.

Donald Trump can influence market sentiment, accelerate sector rotations, and trigger temporary excesses. He cannot prevent a well-managed company from creating value year after year.

It is precisely within this gap between political noise and economic reality that long-term investment opportunities emerge.

Historically, political shocks tend to produce short-term market movements. Over time, markets stabilize as economic fundamentals reassert themselves.

Selling during moments of panic often leads to poor outcomes. The key factors remain the quality of the companies owned and the investor’s time horizon.

By identifying high-quality companies that become temporarily undervalued and maintaining discipline. These periods can offer attractive entry points for long-term investors.

Because they possess durable competitive advantages, solid cash flows, and an ability to adapt that extends far beyond election cycles.