Is silver a good investment in 2026? A full journalistic analysis of silver: historical role, supply and demand, real interest rates, inflation, comparison with gold and bitcoin, risks, scenarios, and allocation strategies.

An ancient metal, long overlooked, now returning abruptly to the spotlight

Silver has accompanied human economic history for thousands of years. Long before modern financial markets existed, it served as money, a medium of exchange, and a store of value. In many civilizations, it circulated in daily life, while gold remained the preserve of elites and states. This historical role still explains silver’s reputation as the “people’s metal”: more accessible, more tangible, but also more unstable.

Over the course of the twentieth century, silver gradually lost its official monetary role, eclipsed by fiat currencies and by gold, which remained stored in central bank vaults. For more than a decade, silver stayed in the background: too volatile for conservative investors, too industrial to be viewed as a pure safe haven, and often ignored in favor of gold or newer assets such as bitcoin.

Then, almost without warning, silver returned to the global financial conversation. In 2025, it delivered one of its strongest performances in more than forty years. This surge was not the result of a simple speculative frenzy. It was driven by a rare alignment of historical, industrial, and macroeconomic forces that restored silver’s unique status as a hybrid asset, positioned between a strategic raw material and a tool for capital protection.

Understanding silver today therefore requires moving beyond price charts. It requires examining industrial supply chains, monetary policy, geopolitical balances, and investor behavior in a world that has become structurally unstable.

Silver’s unique properties and its central role in the modern economy

While silver retains historical and symbolic significance, its current relevance is primarily rooted in its physical properties. It is one of the most efficient electrical conductors known, highly malleable, reflective, and naturally antibacterial. These characteristics explain why silver has become indispensable across many strategic sectors.

Modern electronics, semiconductors, communication networks, electric vehicles, medical applications, and above all solar panels all rely on silver. The global energy transition is built on large-scale electrification of infrastructure. Every photovoltaic panel, data center, and smart grid incorporates silver, sometimes in very small quantities per unit, but in enormous volumes at the global level.

Although industry continually seeks to reduce silver content per component in order to control costs, the growth in total installations more than offsets these efficiency gains. The result is a structurally strong industrial demand, relatively independent of financial trends, and likely to remain elevated as long as energy transition and digitalization continue.

This reality sharply distinguishes silver from gold. While gold is largely stored as jewelry or financial reserves, silver circulates, is consumed, and in many cases disappears permanently into industrial applications that are not economically recyclable.

A constrained and rigid supply facing structural demand

On the supply side, silver suffers from a major limitation: rigidity. Unlike many commodities, silver is rarely mined as a primary product. In most cases, it is a by-product of copper, zinc, lead, or gold mining.

This feature severely limits the market’s ability to respond to higher prices. Even if silver prices were to double, it would not automatically trigger a wave of new silver-focused mines. Production decisions depend primarily on the economics of base metals, not on silver itself.

At the same time, a well-documented trend has emerged. For several years, global silver consumption has exceeded combined mine production and recycling. Available inventories have been steadily declining, making the market increasingly sensitive to industrial, financial, or geopolitical shocks.

Historically, this type of imbalance creates fertile ground for volatility and asymmetric price movements. A relatively modest increase in demand can trigger disproportionate price increases, precisely because supply cannot adjust quickly.

The key macroeconomic factor: understanding real interest rates

To understand why silver and gold react so strongly to monetary conditions, one concept is essential: real interest rates.

A real interest rate is simply the nominal interest rate minus inflation. If a bond yields 4% while inflation runs at 3%, the real return is roughly 1%. If inflation exceeds nominal yields, real rates turn negative, meaning purchasing power declines despite earning interest.

Precious metals, which generate neither interest nor dividends, are highly sensitive to real rates. When real rates are high, holding silver or gold becomes costly in opportunity terms. When real rates are low or negative, these metals regain appeal as stores of value.

Today’s environment is characterized by historically high public debt, shrinking fiscal flexibility, and central banks caught between fighting inflation and supporting fragile economies. This tension creates lasting uncertainty around the future path of real interest rates.

Silver benefits from this backdrop, often with greater amplitude than gold. Where gold tends to dampen shocks, silver amplifies them. This explains both its performance potential and its structural risk.

Silver, gold, and bitcoin: three responses to the same loss of confidence

Comparing silver with gold and bitcoin helps clarify its role. Gold remains the benchmark safe-haven asset. It is held by central banks, universally recognized, and relatively stable. It protects against crises of confidence but rarely delivers explosive upside.

Silver occupies an intermediate position. It shares gold’s monetary attributes while adding direct exposure to industrial activity. This dual nature makes it more volatile, but also potentially more rewarding when multiple drivers align.

Bitcoin follows a different logic altogether. As a digital asset with no industrial use and a short monetary history, it depends heavily on global liquidity, market sentiment, and technological adoption. Unlike gold and silver, it has not consistently demonstrated safe-haven behavior during periods of systemic stress.

In recent episodes of tension, gold and silver captured defensive flows, while bitcoin behaved more like a risk asset.

The different ways to invest in silver

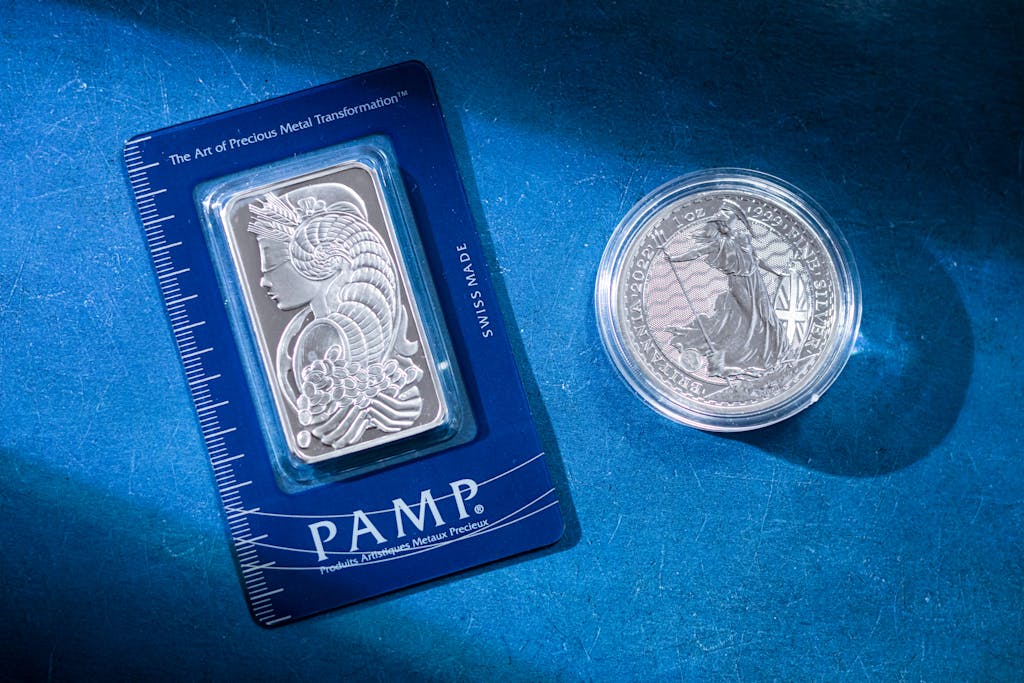

Investing in silver can take several forms, each suited to a specific objective. Physical silver, in the form of coins or bars, offers maximum protection against systemic risks but involves storage, security, and liquidity constraints.

Silver-backed ETFs provide simple, liquid, and efficient exposure to the metal’s price, at the cost of limited but real counterparty risk. Mining stocks introduce additional leverage: they can outperform when silver prices rise but expose investors to operational, political, and financial risks inherent to the mining sector.

Derivatives such as futures and options are designed for experienced investors and are not appropriate as core portfolio holdings.

The choice of vehicle depends less on one’s opinion of silver than on the role it is meant to play within a portfolio: protection, diversification, or performance enhancement.

Volatility and discipline: why silver should not be overweighted

One of the most important points to understand before investing in silver is its volatility. The silver market is smaller than gold’s, more sensitive to financial flows, and more exposed to economic cycles. This results in price movements that are often rapid and sometimes violent, in both directions.

This volatility is part of silver’s DNA. It explains its upside potential but demands strict allocation discipline. Silver is generally not an asset to overweight in a balanced portfolio. A moderate exposure, integrated into a broader diversification framework, is usually more coherent than a concentrated bet.

Silver is not meant to replace core portfolio assets. Its role is complementary, capable of amplifying certain macroeconomic scenarios while requiring investors to accept the discomfort inherent to its nature.

Scenarios for 2026: between consolidation and continuation of the cycle

After a rapid price surge, a consolidation phase would be consistent with silver’s historical behavior. The metal has always alternated between periods of excess and digestion. Nevertheless, medium-term fundamentals remain supportive.

If industrial demand linked to the energy transition holds, if supply deficits persist, and if real interest rates remain contained, silver could maintain a constructive long-term trajectory despite elevated volatility. Conversely, a sustained return to strongly positive real rates or a severe economic contraction could trigger significant corrections.

Silver is not a comfortable asset. It reflects the economic and monetary tensions of the real world.

Conclusion: a demanding but strategically coherent asset

Silver is neither an irrational gamble nor a miracle solution. It is a demanding asset that forces investors to accept uncertainty and volatility. Yet it is also one of the few assets positioned at the intersection of three defining forces of our era: industrial transformation, monetary fragility, and the search for capital protection.

In 2026, silver should not be dismissed as a speculative curiosity. It deserves a measured, disciplined allocation within a coherent macro-driven portfolio strategy.

In a world where certainties are eroding, hybrid assets like silver do not disappear. They return. And sometimes, they remind us—brutally—that stability always comes at a price.

Silver can be a relevant investment in 2026 as part of a diversification and partial capital-protection strategy. Structural industrial demand, combined with constrained supply and an uncertain macroeconomic environment, supports its medium-term relevance. However, its high volatility requires a measured and disciplined allocation.

Gold is primarily a monetary safe-haven asset, held by central banks and historically stable. Silver combines a monetary role with significant industrial usage. This dual nature makes silver more volatile than gold, but also potentially more performant when industrial growth and monetary stress occur simultaneously.

The silver market is smaller than the gold market and more sensitive to financial flows. In addition, a significant portion of demand depends on industrial activity, making silver more cyclical. Finally, supply is rigid and largely derived from by-product mining, which can amplify price movements during periods of imbalance.

Real interest rates, defined as nominal interest rates adjusted for inflation, have a direct impact on silver’s attractiveness. When real rates are low or negative, silver becomes more appealing as a store of value. Conversely, sustained high real rates tend to weigh on silver prices.

Physical silver provides maximum protection against systemic risk but involves storage, security, and liquidity constraints. ETFs offer liquid and straightforward exposure to silver prices, with limited but real counterparty risk. The appropriate choice depends on the investor’s objectives and risk profile.

Due to its volatility, silver should generally not represent a large share of a balanced portfolio. A moderate allocation, integrated within a broader diversification strategy, is usually more appropriate than an overweight position.

Silver can offer partial protection against inflation, particularly when inflation coincides with low or negative real interest rates. However, its performance is not linear and can vary significantly depending on economic cycles and monetary conditions.

Bitcoin is a digital asset whose behavior remains strongly dependent on liquidity and market sentiment. Unlike gold and silver, it has not consistently demonstrated safe-haven characteristics during periods of systemic stress. These three assets follow different logics and can be complementary rather than interchangeable.